Investors chary of next level amid global odds

Fear of possible recession in some major economies and geopolitical escalations in Middle East building pressure on domestic market

Investors chary of next level amid global odds

It’s very difficult to predict when the next recession or stock market crash will come, so many of the best investors don’t even try. Instead, look for good companies with the strength to make it through the occasional challenging economic environment

Quote of the week:

We don’t prognosticate macroeconomic factors, we’re looking at our companies from a bottom-up perspective on their long-run prospects of returning — Mellody Hobson

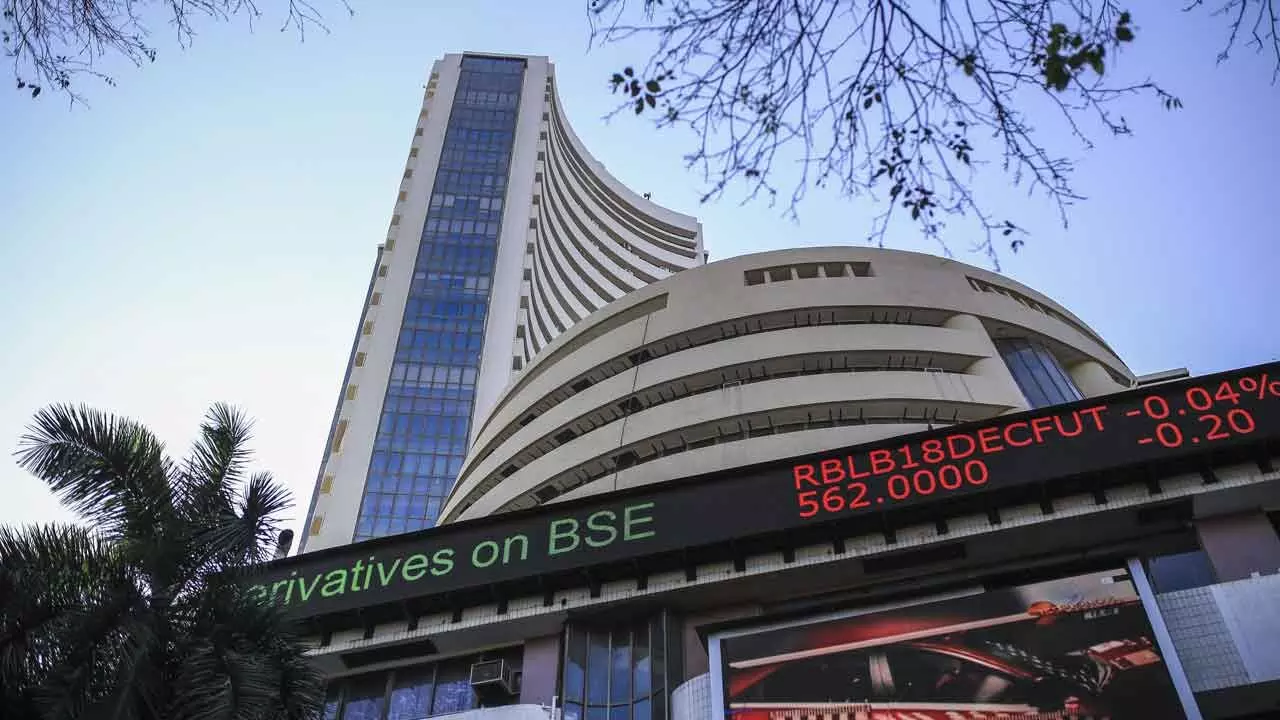

Spooked by the weakness in global markets, the domestic stock market snapped eight-week winning streak after Friday’s (August 2) correction erased the weekly gains. It is pertinent to observe that during the week ended, the benchmarks recorded a fresh all-time high after the US Fed indicated possible rate cut at the September meeting due to easing inflationary pressures. On August 1, NSE Nifty touched a fresh record high of 25,078.30 points, while BSE Sensex hit a new high of 82,129.49 points. The Sensex fell 350.77 points or 0.43 percent to end at 80,981.95, while the Nifty lost 117.15 points or 0.47 per cent to close at 24,717.70 points during the week ended. Broader markets were a tad better with the BSE Mid-cap Index closing on flat note and the BSE Small-cap Index inching up by 0.6 percent. FIIs extended their selling with equity sales worth Rs12,756.26 crore. However, DIIs compensated by buying equities worth Rs17,226.06 crore. The Indian rupee fell to a record low, but ended flat against the US dollar at its close at 83.74 on August 2.

In terms of the market value, Tata Consultancy Services (TCS) lost the most, followed by Infosys, Mahindra & Mahindra and ITC. On the other hand, HDFC Bank, NTPC and Asian Paints added the most of their market-cap. In the week ahead, the RBI is expected to maintain the current benchmark interest rate during its upcoming Monetary Policy Committee (MPC) meeting on August 8. Since the Repo rate was last increased to 6.5 per cent in February 2023, it has remained unchanged in the subsequent eight bi-monthly meetings. If the RBI decides to keep rates steady again, it will mark the ninth consecutive time the benchmark rate remains unchanged. The RBI faces the challenge of deciding on interest rates amid ongoing inflation concerns, particularly food inflation. Retail inflation increased to 5.08 per cent year-on-year in June, up from a 12-month low of 4.75 per cent in May. GST collections were ₹1.82 trillion in July, marking a 10.3 per cent year-on-year increase. A potential stagnant or decline in collections during August (compared to July) is anticipated due to the monsoon season’s impact on overall economic momentum. In the back drop of fear of possible recession in some major economies and geopolitical escalations in Middle East dragged indices from record levels. Turbulent global economy and financial markets is not good news for the Indian market. With markets at peak valuations, when risks abound, caution should be the watchword.

It’s very difficult to predict when the next recession or stock market crash will come, so many of the best investors don’t even try. Instead, look for good companies with the strength to make it through the occasional challenging economic environment.

F&O / SECTOR WATCH

After reaching a record high during the course of week ended, the Nifty ended in the red with a slight correction of half a percent, while the Bank Nifty closed relatively unchanged. Nifty futures saw fresh short build up accompanied by increase in open interest. In the option segment, the Nifty options indicated significant Call open interest at the 25,000 and 25,500 strikes, while the substantial Put open interest was observed at the 24,500 and 24,000 strikes. As for the Bank Nifty, significant Call OI was stood at the 53,000 and 52,000 strikes, while the highest Put OI was seen at the 50,500 strikes. Implied Volatility (IV) for Nifty’s Call options settled at 11.54 per cent, while Put options conclude at 12.07 per cent. The India VIX, a key market volatility indicator, closed the week at 12.93 per cent. India VIX surged higher by 16.92 per cent on a weekly basis. The Put-Call Ratio of Open Interest (PCR OI) stood at 1.52 for the week. The levels of 25,000 and 25,150 are expected to act as immediate resistance levels for the Nifty.

The supports come in at 24,500 and 24,280 levels. The strong support area for Nifty is in zone of 24,500-24,400 points, while on higher side 24900-25000 zone will likely to act as strong hurdle for Nifty, expect some. The market breadth has been weak in the past few sessions suggesting that risk-off sentiment may prevailand this may contribute to all upsides getting sold into as well. Although there are no signs of any major downturn, some amount of measured corrective moves or a broad-ranged consolidation can’t be ruled out. Market will be reacting to the earnings reports of major companies like State Bank of India (SBI), Divi’s Laboratories, Titan Company, and Britannia Industries; when markets resume trading on Monday. Impact of Sebi clampdown on F&O segment by steps like raising upfront margin requirements and increase contract value multi-fold may become visible by the end of the month. Stock futures looking good are Ambuja Cements, Chambal Fertilisers, Exide Inds, IEX, Indigo, Sun Pharma and United Spirits. Stock futures looking weak are Atul, BOB, Bandhan Bank, Cummins India, DLF, IRCTC and PEL.

(The author is a senior maket analyst and former vice- chairman, Andhra Pradesh State Planning Board)

STOCK PICKS

CG Power and Industrial Solutions Ltd

CG Power and Industrial Solutions Ltd is engaged in providing end-to-end solutions to utilities, industries and consumers for the management and application of electrical energy. The company’s segments include Power Systems and Industrial Systems. The Power Systems segment is engaged in the manufacturing of electric equipment for the power and industrial sector and manufactures and sells products such as transformers and reactors, switchgear products and also offers turnkey solutions in power distribution and generation. The Industrial Systems segment is engaged in the manufacturing and sale of power conversion equipment, which includes a wide spectrum for all industrial applications of medium and low voltage rotating machines, drives and stampings for all industrial applications, equipment and solutions to Indian railways for rolling stock, traction machines, railway propulsion control equipment, coach panels and signalling equipment.

CG forayed into Semiconductor Manufacturing as a part of its Strategic Diversification. CG along with Renesas Electronics Corporation, a premier supplier of advanced semiconductor solutions; and Stars Microelectronics (Thailand) Public Co Ltd, a Thailand-based outsourced semiconductor assembly and test (OSAT) provider; had during the year signed a joint venture agreement (JVA) to establish a joint venture (JV) to build and operate an OSAT facility in India. The JV, CG Semi Pvt Ltd, will set up a world-class OSAT facility in Sanand, Gujarat. Buy for medium-term target of Rs1,250.